Life Insurance in and around Indianapolis

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

People purchase life insurance for individual reasons, but the purpose is normally the same: to secure the financial future for the people you're closest to after you're gone.

Protection for those you care about

Now is the right time to think about life insurance

Put Those Worries To Rest

When opting for how much coverage is right for you, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like your current age, how healthy you are, and perhaps even lifestyle and gender. With State Farm agent Dan Blackley, you can be sure to get personalized service depending on your specific situation and needs.

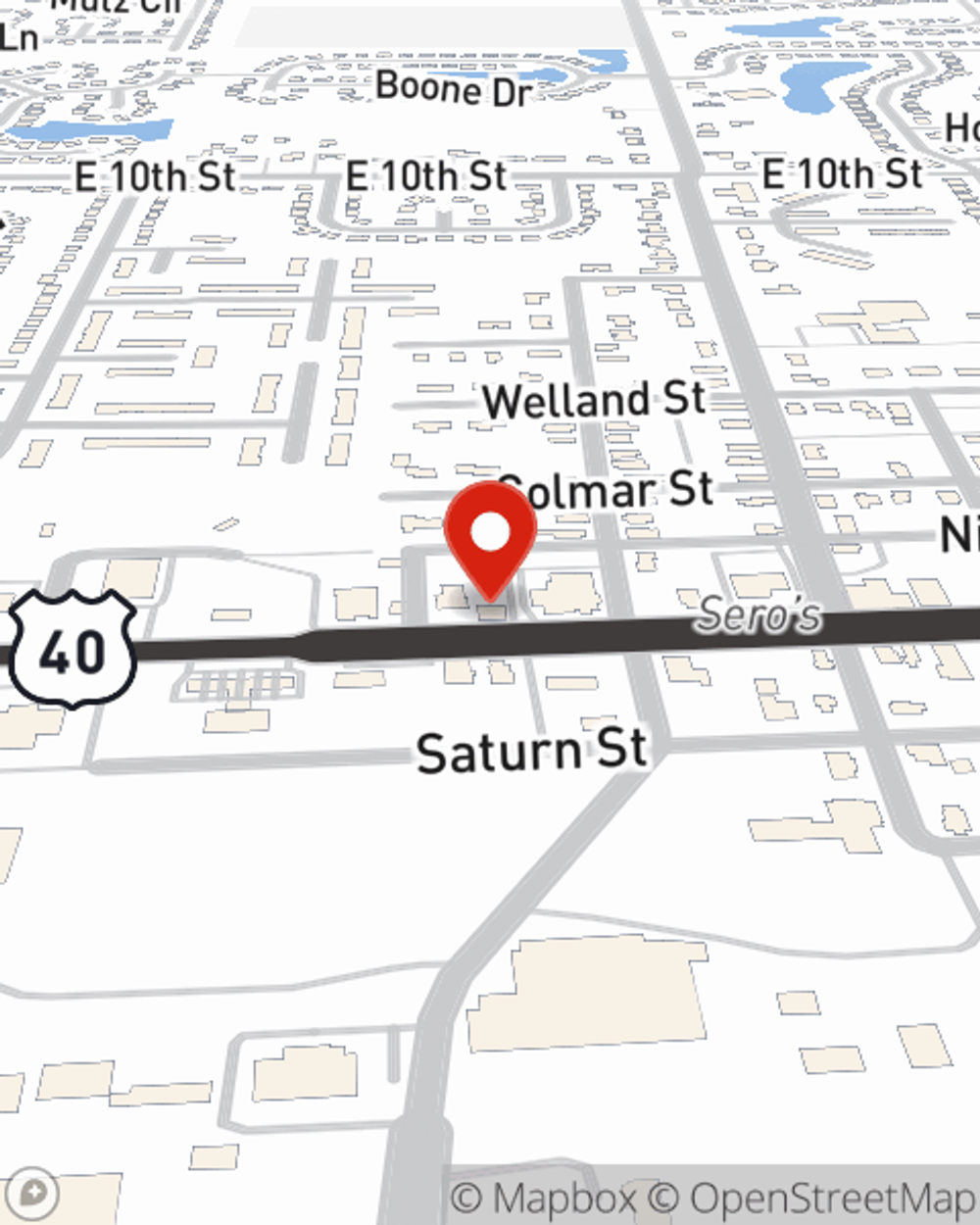

Visit State Farm Agent Dan Blackley today to see how the trusted name for life insurance can ease your worries about the future here in Indianapolis, IN.

Have More Questions About Life Insurance?

Call Dan at (317) 897-8532 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Dan Blackley

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.